⚖️ The TeamHealth v. UnitedHealth lawsuit is an illuminating chronicle of bad blood between insurers and providers

Legal contest also reveals key evidence on surprise billing

One is team health and the other is united health - but their definitions of a “reasonable” price for healthcare couldn’t be more at odds.

The TeamHealth v. UnitedHealth lawsuit filed in July is a torrid chronicle of bad faith, at times hilariously punctuated by frustrating customer service calls from TeamHealth made to a third party billing analysis firm called Data iSight, which Team accuses of being in cahoots with United in a racketeering conspiracy.

The lawsuit also reveals that A., Team has been trying to charge United lucrative prices upwards of 750 percent of Medicare rates for out of network patient visits, while simultaneously presenting damning evidence that B., Data iSight’s supposedly “Defensible, Market Tested” reimbursement determinations were nothing of the sort.

United has subsequently since given notice to Team that it plans to cancel two-thirds of its contracts over the next 11 months, leading Moody’s to downgrade the emergency provider’s bond rating. Team’s response? We’re lawyering up. As a company representative told HealthLeaders:

"As Team Health continues to see more aggressive and inappropriate behavior by payors to either reduce, delay, or deny payments, we have increased our investment in legal resources to address specific situations where we believe payor behavior is inappropriate or unlawful," the company said.

The whole episode is reminiscent of a recent Tweet from Brian Riedl, a conservative economist who worked on the Romney and Rubio presidential campaigns:

God knows what the United v. Team legal battle is costing. Suffice to say that when one of the largest emergency physicians groups in the country and the largest insurance company in the country are in a spat like this, it’s a good bet there’s more going on than a simple billing dispute.

Relative negotiating power in American healthcare, TeamHealth v. UnitedHealth edition

As I’ve written previously, pricing in healthcare is all about the relative negotiating positions of the respective parties involved - and not about how much the healthcare actually costs to deliver.

In this case, Team’s filing points out an additional factor that plays into that power dynamic, namely EMTALA, the federal law requiring emergency providers to treat patients regardless of their ability to pay.

Team asserts:

Because the law requires that emergency services be provided without regard to insurance status, the law protects emergency service providers from predatory conduct by payors. If the law did not do so, emergency service providers would be at the mercy of insurance plans…

To what degree EMTALA implies protection from predatory conduct - and whether said conduct is predatory in the first place - will be left to the court. But it is true, and has been since EMTALA was passed in 1986 under the Reagan administration, that the doctors in the ER have a duty to treat whoever walks through their door regardless of ability to pay.

What happens afterward in terms of billing those patients for services provided is another matter. Regardless, Team argues that its duties under EMTALA put it at a relative negotiating disadvantage against the insurance companies.

What is a “reasonable rate” for out of network service?

This is the key question raised by the lawsuit. Team claims that the reasonable rate for out of network services is “well-established,” at a historical payment rate of 75 - 90 percent of billed charges. Meanwhile, Team alleges that United has been reducing reimbursement rates to 20-40 percent of billed charges.

Leave aside for a moment the fact that Team is not being asked to justify its billed charges. [In fact, how a provider determines what to bill in the first place should be getting far more scrutiny].

The disagreement here is central to the debate over surprise billing that is currently playing out in Congress and in public relations and lobbying campaigns. If the preferred physicians group solution prevails, it’s more likely companies like Team will get to keep its lucrative reimbursement rates seven or eight times that of Medicare. If the insurance company solution prevails, companies like Team may be forced to accept much lower rates.

So, which version is “reasonable”?

United’s Sordid Past

In order to make its case, Team points to United’s 2009 settlement of a case in which it was investigated for using a wholly-owned subsidiary called Ingenix to illegally manipulate reimbursements to out of network providers.

United settled the case and was forced to pay $50 million to fund an independent nonprofit organization called FAIR Health. The same year, United paid $350 million to settle a lawsuit with the American Medical Association to settle claims that they were under-paying out of network providers.

Since then, FAIR Health’s databases “have been used by state government agencies, medical societies, and other organizations to set reimbursement for non-participating providers,” according to the filing. Essentially, Team is saying: if you want to look for a reasonable rate, look to FAIR Health.

But instead of using FAIR Health, United is now using a different company: Data iSight. This is where the story gets really good.

The Racketeer Influence and Corrupt Organizations Act

Team alleges that UnitedHealth and Data iSight are engaged in a criminal racketeering enterprise and should be held to account under The Racketeer Influence and Corrupt Organizations Act, or RICO.

Yes, this RICO:

Team alleges that Data iSight essentially acted at the behest of United to help the insurance giant reduce reimbursement rates, adding a thin veneer of third-party legitimacy when in fact Data iSight’s methods were whatever United wanted them to be.

For example, Data iSight’s circa-2000 website claims to have a “PATENTED approach” to reimbursement for out of network bills “that is DEFENSIBLE, market TESTED, and completely TRANSPARENT to all parties.” [Capitalization is theirs]

Here is their home page:

Team’s court filing aims to debunk every claim on that page, save perhaps the one that it is a “patented” approach.

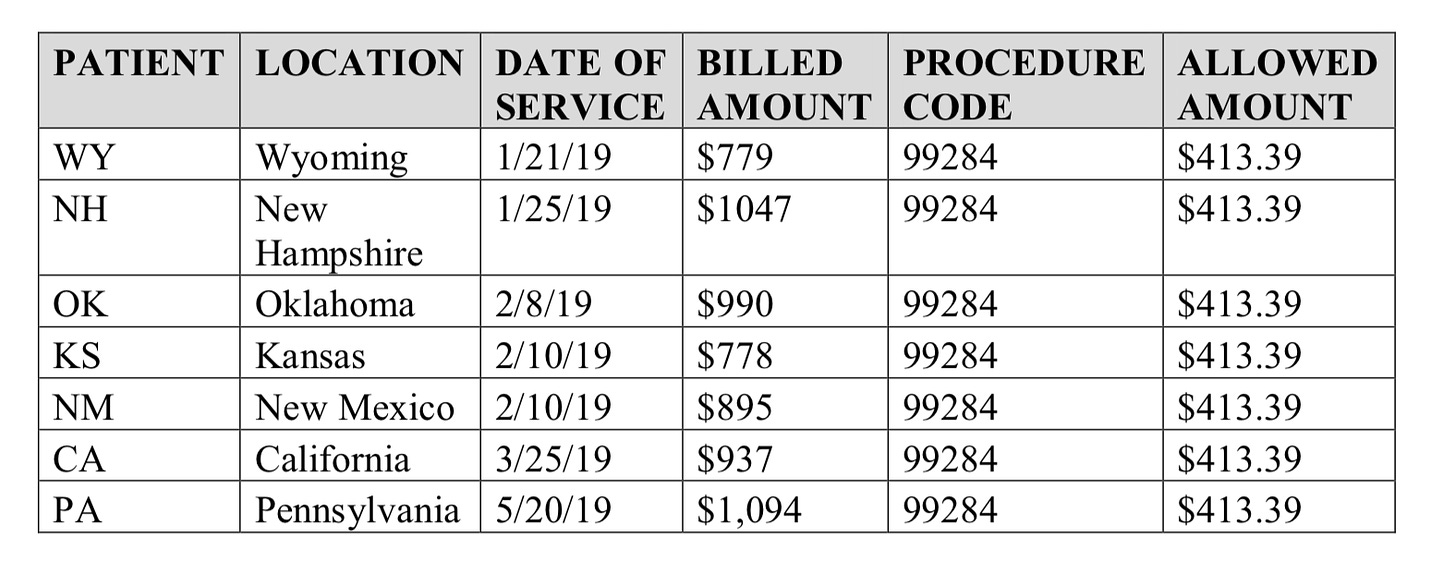

In one example, Team takes up Data iSight’s claim (outlined elsewhere on its site) that it applies the CMS Geographic Practice Cost Index to account for regional differences in cost of care. To counter this, Team presents seven different charges in seven different states, from California to New Mexico to New Hampshire, all with the exact same procedure code 99284, one used when a high severity patient comes for treatment.

No matter in what state the claim was made in, Data iSight allowed the same exact amount: $413.39:

That’s hardly adjusting for regional differences.

In another extended section, Team tries to test Data iSight’s claim that it provides “transparency for providers” by trying to get explanations for why the company recommended lower reimbursements for two of Team’s claims.

The saga begins with calls to iSight’s customer service lines:

After Plaintiffs left messages at Data iSight’s phone number for approximately two weeks, a Data iSight representative, Phina (Last Name Unknown) (“LNU”), finally connected with Plaintiffs; however, she was unable to explain why the two claims – for the same procedure at the same facility and billed at the same charge – were allowed at different rates.

As recounted by the filing, Data iSight’s customer service representatives were repeatedly evasive and unable to provide any explanation:

When Plaintiffs continued to pursue the issue and spoke with a Data iSight supervisor, James LNU, to inquire as to the basis for these determinations, James LNU responded that “it is just an amount that is recommended and sent over to United [Defendants].”

When James LNU was expressly challenged on Data iSight’s false claim that it is transparent with providers, he responded with silence.

If this suit ever goes to trial, no doubt jury members will be able to sympathize with Team’s experience trying to get answers out of Phina and James. Anyone who has ever tried to get an explanation about costs and pricing from anyone in healthcare will find the experience familiar.

Team concludes the episode:

Further attempts to understand Data iSight and obtain information about the basis for its reimbursement rate-setting from Data iSight executives have also been futile.

Going out of network is lucrative

Still. Even if Data iSight is just a puppet of United being used to generate phony rationales for stiffing well-meaning ER physicians, that doesn’t mean the “reasonable rates” being requested by Team are in fact reasonable.

They may be historical, as Team alleges, but that doesn’t mean they are reasonable. Brookings Institute health policy researcher Loren Adler points out that the reimbursement rates Team is complaining about are still multiples higher than Medicare rates:

Note: Adler sincerely apologies in a subsequent tweet for his poor MS Paint “handwriting.”

The point is that while TeamHealth asserts that it should at least get 75 - 90 percent of what it asks for, what they’ve asked for is often eight or nine times higher than what the government reimburses for that level service.

Disclosing that in court may not win any fans for TeamHealth, whether among the public or in Congress as it decides if and how to protect patients from exactly those kinds of out of network bills. Meanwhile, if the allegations here are true, it would appear UnitedHealth is engaging in the exact same kind of price manipulation that triggered the fines back in 2009.

Neither side comes out clean in this filing. But at least one thing is made abundantly clear: whatever this lawsuit is about, it’s certainly not about what’s in the interests of patients.